Marketplace Morning Report

by Marketplace

In less than 10 minutes, we'll get you up to speed on all the news you missed overnight. Throughout the morning, Marketplace's David Brancaccio will bring you the latest business and economic stories you need to know to start your day. And before U.S. markets open, you'll get a global markets update from the BBC World Service in London.

Episodes

2026: the year of partial government shutdowns

<p>We just had a partial government shutdown, and now we're edging closer to another. It would involve just one federal agency — the Department of Homeland Security. DHS will run out of money this Saturday if Congress doesn’t reach a compromise over ICE and pass a funding bill, but other agencies would be affected. Also on the show: the jobs report, buyers of U.S. debt, and Russian strikes on Ukrainian heating systems.</p>

Thank you for (permission for) the music

<p>Twice now, figure skaters at the Winter Olympics were told the music they wanted to skate to — and had been practicing to — could not be used. Spain's Tomàs-Llorenç Guarino Sabaté, who wanted to skate to songs and sounds from "Minions," has since secured the rights. Today, we look into the complicated world of sports, music, and copyright. Also on the program: stocks soar in Japan and what warming waters mean for Maine's fishing industry.</p>

What you need to know about TrumpRx

<p>The Trump administration has launched the new TrumpRx website, where people can shop for prescription drugs at discounted rates. The site, a hub that points cash-paying customers to five participating manufacturers' websites, went live yesterday. We dig in. Then, it's been a bumpy week for markets. What should we make of it? Plus, we speak with a Minneapolis restaurant owner who says sales are down 50% due to ICE's crackdown in the city.</p>

AI comes for software companies

<p>Software companies are in trouble. Or at least their stocks are. Salesforce is down 25%, and Intuit is down 31%, after startup Anthropic released a new tool sparking fear among investors that software companies are in danger of becoming obsolete. We'll learn more. Then, all kinds of cryptocurrencies are cratering in value, and we'll hear what it's like to be a small business in an anemic job market.</p>

Japan prepares to go to the polls

<p><em>From the BBC World Service:</em> Japanese voters will give their verdict on the government of Sanae Takaichi this weekend after Japan's first female prime minister called a snap election just months into her first term. How is the economy there shaping the election? Plus, Cuban President Miguel Díaz-Canel says his government is trying to solve an energy crisis exacerbated by U.S. sanctions. And we check in with a company on a tiny Scottish island that produces an essential piece of Winter Olympics equipment.</p>

Raised voices at a hearing starring the treasury secretary

<p>Treasury Secretary Scott Bessent will be on Capitol Hill again today for another grilling. He’s scheduled to appear before the Senate Banking Committee. Yesterday, Bessent appeared before the House Financial Services Committee to talk about oversight of the U.S. financial system, where he sparred with Democrats. And later in the program, wages are making up a shrinking share of overall income. Also: discussions of Fed independence, inflation, and more.</p>

The continuing struggles of the news biz

<p>News Corp — the parent company of The Wall Street Journal, Barron's, MarketWatch, and Fox News — announces quarterly profits today. Meanwhile, The Washington Post laid off a third of its staff yesterday. Today, we'll delve into the state of the media industry and why it's such a struggle to find a business model that works. Then, Amazon Fresh and Amazon Go is closing up shop. What went wrong with Amazon’s foray into physical stores?</p>

Care for a little treat?

<p><em>From the BBC World Service:</em> Little luxuries can become routine during tougher economic times. The newest iteration of the “lipstick effect,” the phenomenon is called "little treat culture" on TikTok, where videos using the hashtag have grown by 75% globally over the past year. This morning, we'll delve into the business model of treat-onomics. But first, TSMC confirms plans to make AI semiconductors in southern Japan, and gig workers in India are planning a nationwide strike.</p>

A change to small business loans for immigrants

<p>The Small Business Administration will no longer allow green card holders to apply for SBA loans. The new policy was announced on Monday and takes effect next month. This program doesn’t lend money directly to businesses; it provides loan guarantees to lenders, and the loans are usually cheaper than traditional borrowing. We learn more. Then, for older people, financial strain may be a warning sign of dementia — before doctors or families start noticing symptoms.</p>

Even an econ degree does not insulate you from AI

<p>Is a degree in economics, long considered a path to stable employment, even worth it in the age of AI? Recent research suggests entry-level economics and business jobs may be especially exposed to automation. That could leave college students wondering if their degree will be outdated by the time they hit the job market. Today, we'll hear how students and schools are adapting. Plus, work requirement changes to SNAP benefits could impact millions of recipients.</p>

WWKD?

<p>Of course, we mean "What would Kevin do?" — Kevin Warsh, that is, President Donald Trump's nominee for Federal Reserve chair. And it's a question plenty of investors are asking as they try to feel out his views on inflation and Fed independence. We'll unpack. Plus, we'll head to Venezuela, where acting President Delcy Rodríguez signed a law last week opening the oil industry there to private ownership after two decades.</p>

Who is Trump's Fed chair pick?

<p>This morning, President Donald Trump revealed his choice to lead the Federal Reserve: It's Kevin Warsh, a former Fed governor and more recent Fed critic. If confirmed by the Senate, Warsh would replace Jerome Powell, whose term expires in May. Warsh had called for "regime change" at the Fed. On today's show, we'll dig into Warsh's background and perspective. Plus, from "Marketplace Tech," we'll hear how a Nevada startup is taking used electric vehicle batteries to help power a data center.</p>

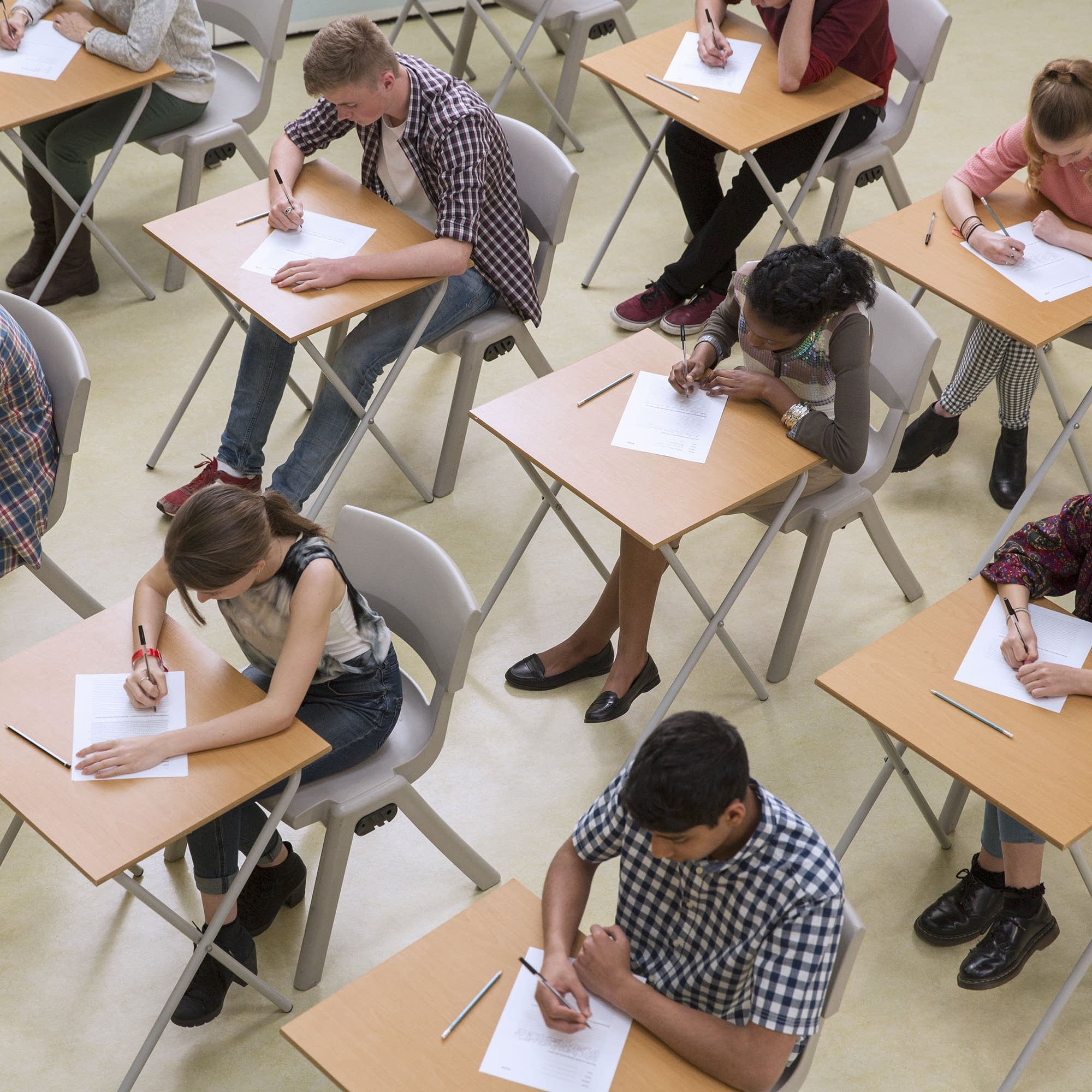

How schools teach about capitalism is changing

<p>An increasing number of states in the U.S. not only require high schools to teach financial literacy but also require them to incorporate the fundamentals of free-market capitalism into their lesson plans. We head back to the classroom to hear how these lessons are changing as a growing number of students voice skepticism about capitalism. (Need to head back to Econ 101? <a href="https://www.marketplace.org/news-quiz" class="default">Take our quiz to find out</a>.) Plus, following last week's economic blackout in Minneapolis, we examine the history of general strikes in the U.S.</p><br/><p></p>

What you need to know about those 'Trump Accounts'

<p>The Trump administration held a summit yesterday, all about Trump Accounts — those are investment accounts for babies born during his term. The government has promised to contribute $1,000 to every American child, no matter what their family’s income is. We’ll help you understand the details. Plus, we'll learn how vital Latino-owned businesses are to the economy and unpack the Federal Reserve's decision to leave interest rates unchanged.</p>

The messy, tricky, hairy task of economic forecasting

<p>We’ve been deluged with the annual economic and market forecasts that traditionally mark the turn of a new year. Is it worth paying attention to these forecasts, or are they a waste of time? Maybe a little bit of both? Today, we're joined by Marketplace senior economics contributor Chris Farrell to assess their worth. But first, we'll discuss some of the forecasts and market conditions the Federal Reserve has in mind at this week's meeting. And, Boeing’s revenue is up, as are its airplane delivery numbers.</p>

TikTok is here to stay

<p>TikTok says it has formed a joint venture for U.S. operations with majority American ownership. The deal is intended to address national security concerns that led to a law that would have banned the app. Then, the world is now holding more gold than U.S. bonds. Is this a sign of changing times? And later, we discuss Americans’ savings rate and the impact of the upcoming cold snap on spending.</p>

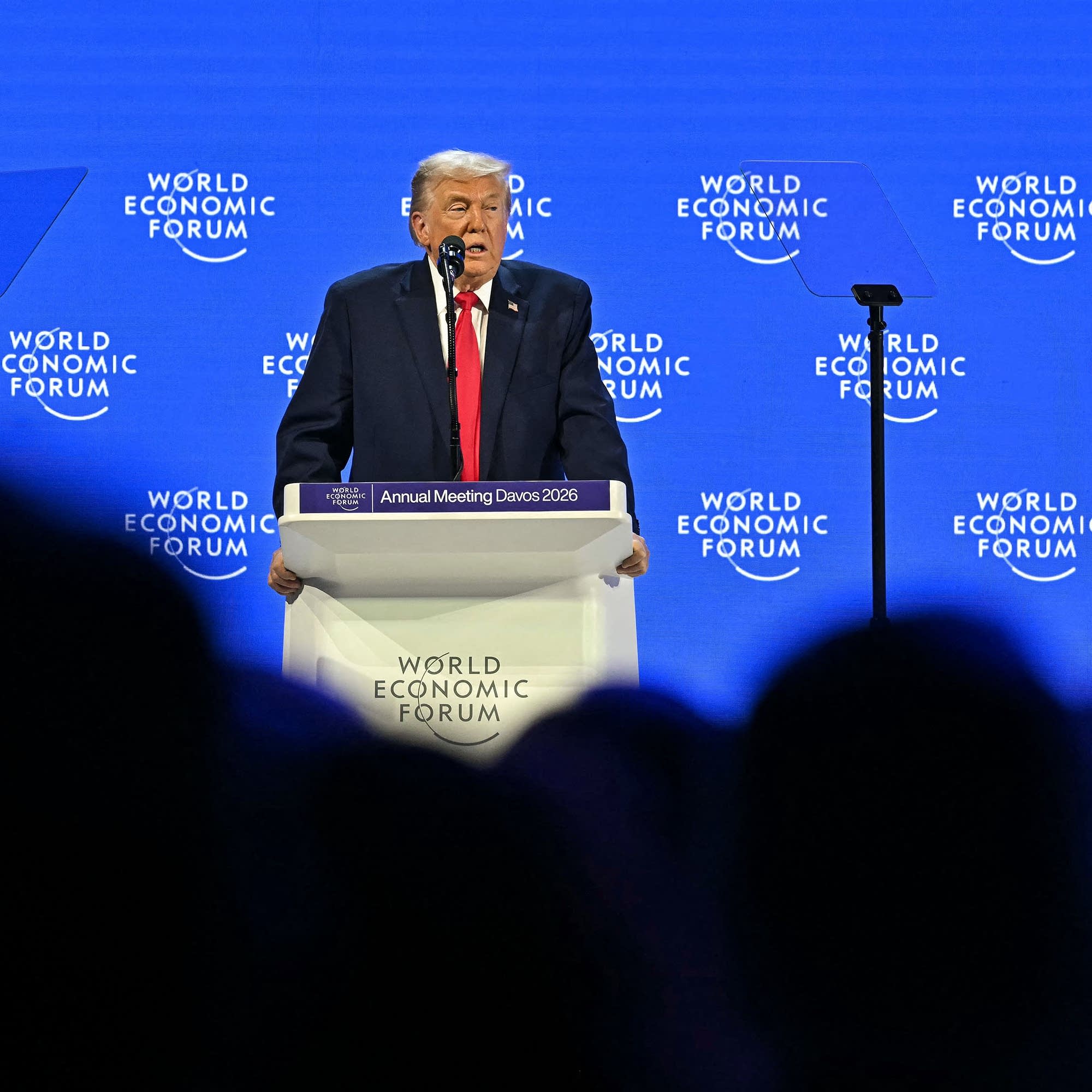

Economic power as a cudgel

<p>Usually a relatively quiet affair, this year’s World Economic Forum made headlines as President Donald Trump walked in with threatening language over wanting to acquire Greenland and left with what he said was a framework deal that would avoid a new trade war. We'll discuss the lasting impact. Plus, TikTok looks to be here to stay. And, from <a href="https://www.marketplace.org/shows/this-is-uncomfortable-reema-khrais" class="default">Marketplace's "This Is Uncomfortable,"</a> we hear about the importance of how people feel about their finances.</p>

How would a credit card interest rate cap even work?

<p>President Donald Trump acknowledged yesterday that he'll need help from Congress to cap credit card interest at 10%. He also talked about this at the World Economic Forum; at another Davos venue, JPMorgan Chase's Jamie Dimon said that capping cards would cause "economic disaster." We dig in. Plus, tax breaks from the "Big Beautiful Bill" should boost the economy (temporarily), and boosting Venezuela's oil production could have serious environmental impacts.</p>

What's next for Cuba after Venezuela?

<p>Following the president's intervention in Venezuela, the Trump administration is escalating threats against several sovereign nations. Now, Cuba is set to lose access to one of its main suppliers of oil, adding pressure to its increasing energy shortage and an already struggling economy. This morning, we'll discuss with the BBC's Will Grant. Plus, President Donald Trump’s pivot on Greenland was well-received on Wall Street, and renter affordability is improving.</p>

Trump, Davos, and markets

<p>On Wednesday, President Donald Trump spoke in front of international leaders in Davos, Switzerland. There, he touted his use of tariffs to disrupt the global trading system and spoke about his aspirations for acquiring Greenland without the use of force. We'll unpack some of the economic headlines. Then, we'll also discuss yesterday's sell-off of stocks and bonds and hear how Russia's war on Ukraine is impacting European airlines’ bottom lines.</p>