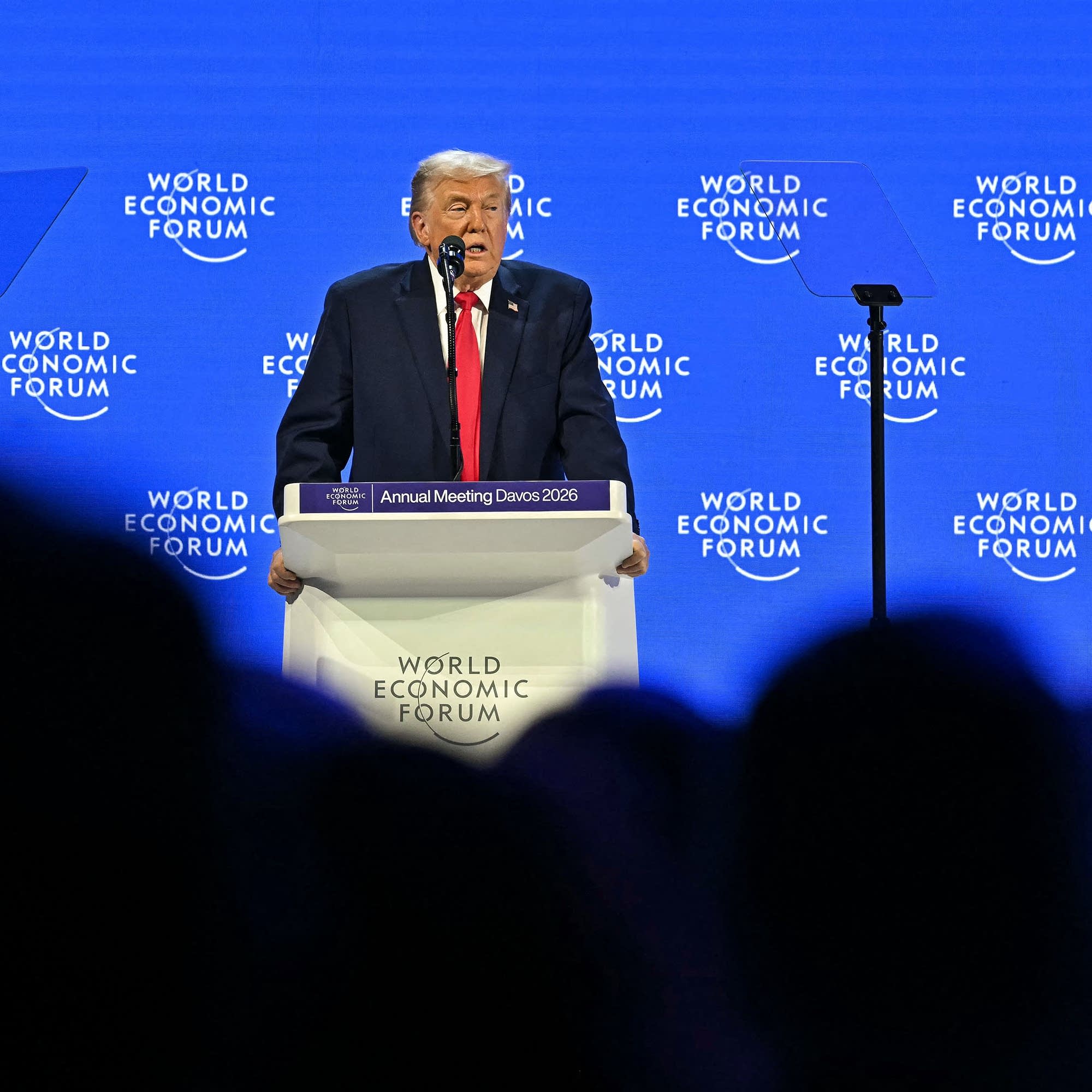

Overview of Trump, Davos, and markets

This Marketplace episode covers President Trump’s remarks at the World Economic Forum in Davos and how his trade posture (including comments about Greenland) is affecting global markets, bond yields and mortgage rates. The show also reports on how expanding conflict zones are changing flight routes, increasing costs and emissions for airlines.

Market reaction to Trump’s Davos speech

- Trump touted tariffs and outlines of trade deals with Japan, South Korea and the EU as growth-positive, saying such deals lift global markets when the U.S. does well.

- He made repeated comments about Greenland — denying rare-earth-minerals as the primary reason for interest and framing it as a strategic security issue — and said the U.S. would guarantee Greenland’s security but “won’t take it by force.”

- European Union lawmakers paused talks on a U.S.–EU trade deal after Trump threatened tariff actions on some EU countries reportedly opposing his Greenland comments.

- Market moves noted in the episode:

- A recent sell-off: Nasdaq fell about 2% during a sell-off; the 10-year U.S. Treasury yield rose to its highest level since the prior summer.

- Mortgage News Daily calculation: average 30-year fixed mortgage increased from ~6.07% to ~6.21%.

- At one point the Dow was up about 0.5% (247 points) while other indexes showed mixed moves.

Fixed-income perspective — “sell America” trade and borrowing risk

- Guest: Guy LeBas (chief fixed-income strategist at Janney Montgomery Scott).

- “Sell America” trade explained: investors shifted away from U.S. dollar assets into European, Japanese and other assets after tariff announcements. It had a visible effect in equities and a brief effect in bonds but was not sustained through the year.

- Key risk highlighted: small shifts in demand for U.S. government debt can materially change borrowing costs because the Treasury issues trillions of dollars annually. That makes changes in yield sensitive to modest reallocations.

- LeBas’s assessment: the risk from recent geopolitical statements (e.g., Greenland) is still modest. The biggest near-term concern is implications for U.S. government financing and mortgage rates rather than direct effects on consumer credit cards.

Aviation and conflict zones: longer flights, higher costs, more emissions

- Source: BBC reporting with data from risk intelligence firm Verisk Maplecroft and German Aerospace Center.

- Findings:

- Areas affected by armed fighting have expanded by ~89% over the past five years.

- Closed or restricted airspace totals about 18 million sq. km (~11 million sq. miles), the largest segregation of airspace since World War II.

- Many carriers (particularly Western airlines) avoid Russian airspace due to the Ukraine war; common Tokyo–London routes now fly farther north (over Alaska), adding time.

- Lufthansa reports some long-haul journeys are up to two hours longer; network planning and fuel costs have been affected.

- Aviation experts estimate each additional minute of flight time raises passenger fares by roughly $1.50 on average.

- Longer routings also increase emissions and pressure airfare profitability, which may affect availability of low-cost and award seats.

Notable quotes & soundbites

- Trump: “Greenland is not about its rare minerals. And just to get to this rare earth, you got to go through hundreds of feet of ice. That’s not the reason we need it. We need it for strategic national security and international security.”

- Guy LeBas: Small reallocations in demand for U.S. Treasuries “can really change the cost of how the U.S. government finances itself.”

Key takeaways

- Political rhetoric at Davos and threats of tariffs can move both equity and fixed-income markets and have real effects on borrowing costs.

- The “sell America” trade has shown up episodically but hasn’t produced a sustained large-scale exodus from U.S. bonds; the larger concern is volatility in demand for Treasury issuance.

- Geopolitical conflicts are reshaping flight routes at scale, adding time and cost to air travel and increasing airline emissions—effects that can feed into higher fares and operational complexity for carriers.

Recommended follow-ups (for listeners who want to dig deeper)

- Track 10-year Treasury yields and Treasury issuance calendars to monitor government-borrowing sensitivity.

- Watch EU–U.S. trade negotiation updates for potential tariff risks and policy shifts.

- For frequent flyers: monitor airline route notices and check fare dynamics if planning long-haul travel that may be subject to rerouting.