Summary — "How to Build a Real Estate Marketplace"

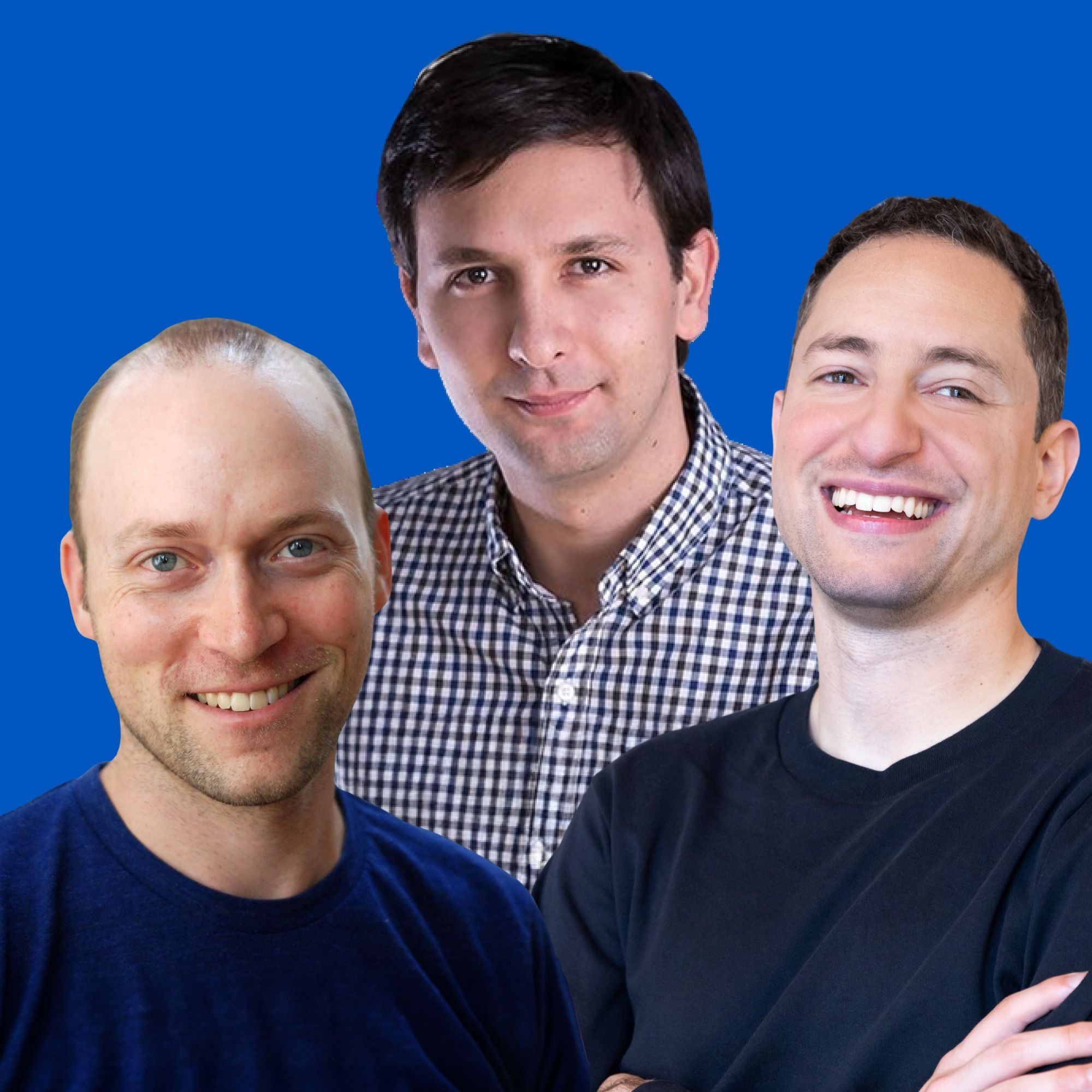

Guests: Kaz Nejatian (Opendoor CEO), Alex (a16z GP); Host: Andreessen Horowitz

Overview

This episode examines why residential real estate has been resistant to large-scale disruption and how Opendoor aims to change that by building a technology-first marketplace for buying and selling homes. The conversation covers market dynamics (supply, demand, cap rates), the entrenched agent/commission system, regulatory/locality challenges, comparisons to Amazon/Carvana/Tesla, and Opendoor’s strategy under new CEO Kaz Nejatian to treat the business primarily as a software and marketplace problem rather than an asset-investing business.

Key points / main takeaways

- Real estate is ripe for disruption but uniquely hard because it is highly local, infrequent, and full of misaligned incentives across many intermediaries.

- The current agent/commission structure creates concentrated benefits for agents and diffuse harm for consumers; many agents do zero transactions in a year (mode = 0).

- Aggregating a relatively small but meaningful share of supply in a local market (e.g., ~5–10%) can attract most of demand and create a marketplace flywheel—analogy to Amazon’s early strategy of dominating a niche to capture demand.

- Opendoor’s vision: be a capital-light marketplace and a software business that stretches the one-off nature of home transactions into longer-term aligned relationships (e.g., returns, trials).

- Past failures to disrupt this market fall into three structural mistakes:

- Solving only a tiny, immediately profitable piece instead of a demand-aggregating use case.

- Relying on traditional channels (which don’t change the system’s incentives).

- Scaling by manual/human operational-heavy methods that aren’t durable.

- Parallels to autos: Tesla and Carvana show how dealer-based models can be unbundled; homes have some advantages (homes don’t need physical transport) but also deep local/regulatory complexity.

- Financing and transaction support (bridge financing, seller financing, packaging executive moves) are underutilized levers that could be productized to improve outcomes and create differentiation.

- Opendoor introduced a buyer “return” program (try a home, return if not satisfied) in Dallas as an example of stretching transactional alignment and consumer protection.

- Kaz notes the challenge and visibility of running a public company (issues that were discussed privately in startups are discussed publicly in Reddit and WSJ), but emphasizes focus on mission over press.

Notable quotes / insights

- “Buying a home is supposed to be the American dream. Instead, it's one of the most painful, opaque, and inefficient markets in the economy.” — Host summary of the mission.

- “Every profession is a conspiracy against the laity.” — Quoted from George Bernard Shaw to describe concentrated industry benefits vs diffuse harm.

- “You don't have to get 100% of the homes in order to get 100% of the users.” — Alex (a16z) on the demand-side leverage of acquiring a critical mass of supply in a market.

- “Opendoor is a software company designed to solve that problem.” — On reframing Opendoor away from an asset-investor mentality to a software/marketplace company.

- “If you care a great deal about what's said about you in the Wall Street Journal, running a public company is incredibly difficult. Luckily, I just don't care.” — Kaz, on the public CEO role.

Topics discussed

- Market dynamics and cap rates (Phoenix vs Bay Area) and how that affects business models

- The MLS, Zillow/Redfin lead-generation model vs a true marketplace

- Commission structures and the principal–agent problem in real estate

- Historical attempts to disrupt real estate and why many failed

- Analogies to Amazon (niche to demand) and Carvana/Tesla (auto market disruption)

- Product ideas: trial/return programs for homes, bundled financing/seller financing, executive-move packages, builder/new-home model lessons

- Locality and regulatory constraints (wet signatures, state-specific rules)

- Operational models: capital-light marketplace vs owning inventory

- Running a public company and the amplified visibility/press

Action items / recommendations

For marketplace founders / operators

- Reframe the problem as a software and marketplace challenge, not primarily an asset-investing business.

- Prioritize acquiring a critical share of local supply to get demand and start a flywheel (Amazon-style niche to broad marketplace).

- Avoid scaling primarily through manual/human-heavy processes; invest in automation and product design that reduce operational labor.

- Integrate financing and other adjacent consumer needs (bridge loans, seller financing, mortgage bundling) to remove frictions and increase value per transaction.

- Stretch transactional alignment by offering post-sale guarantees, trials, or other ways to extend accountability beyond a single event.

For investors / execs thinking about real estate disruption

- Look for companies that combine local market dominance with scalable software primitives.

- Beware of businesses that merely monetize lead generation—look for models that own demand or provide better-aligned incentives to end users.

For Opendoor / incumbents

- Double down on buyer experience and product features that make buying from Opendoor objectively better (returns, early move-ins, financing options).

- Advocate and work around regulatory constraints where feasible (digital closings, state-level reforms).

- Reposition messaging externally and internally to emphasize software/marketplace leverage, not inventory speculation.

Bottom line

Residential real estate offers one of the largest marketplace opportunities left largely unserved by big platform plays because of local complexity, infrequent transactions, and entrenched intermediaries. Success requires a product-first, software-centric marketplace approach that aggregates supply locally, aligns incentives across the chain of services (especially financing), and avoids the pitfalls of human-heavy operational scaling. Opendoor’s strategy under Kaz Nejatian is to refocus the company on that mission and rebuild the flywheel by making buying and selling homes as simple and trusted as online commerce.