Overview of "Let's tour the growing AI economy" (Marketplace)

This Marketplace segment (host Kai Rizdahl, reporting with Megan McCarty Carino) visits Silicon Valley to show how the AI boom is playing out on the ground. The piece moves from a small AI startup (Tinyfish) that helps overlooked hotels appear in search results, to massive data-center facilities being built by firms like Digital Realty, and lays out the economic and community trade-offs: huge venture flows into AI startups, rising demand for data-center capacity, and corresponding strains on local power, water and jobs.

Key points and main takeaways

- The AI economy is both software (startups building AI-enabled products) and heavy physical infrastructure (data centers, power, fiber, water).

- Venture capital poured heavily into AI startups: the transcript cites $222 billion in VC to AI startups in 2025 (65% of US VC that year); Tinyfish raised about $47 million.

- Tinyfish’s product: AI software that extracts pricing/availability from under‑resourced hotel websites (PDFs, simple pages) so small hotels can show up on aggregators like Google Hotels and Expedia.

- Data-center buildout is accelerating: Digital Realty is opening a 430,000 sq. ft. Silicon Valley facility targeted to go live around 2027; leasing and activation depend on utility power delivery.

- Power is the bottleneck: utilities and municipalities must coordinate; studies cited predict data-center-driven energy cost increases (nationwide +8% by 2030; Virginia >25% in some analyses).

- Economic mismatch: while firms spend heavily on AI, local tech job markets can be weak (layoffs continue), and many communities worry they get costs (higher bills, water use) without obvious benefits.

- Organizational adoption signals: McKinsey survey cited — 62% experimenting with AI agents, 32% expect workforce shrinkage as AI adoption grows.

Notable locations, companies and people mentioned

- Tinyfish (Tiny Fish AI) — small startup in Los Altos building AI middleware to surface small hotels in search/aggregators.

- Digital Realty — large global data-center operator (300+ data centers) opening a major facility in San Jose (641 Walsh).

- NVIDIA, Alphabet (Google/Gemini), Microsoft (Copilot), Apple (Apple Intelligence) — public AI-linked firms noted for market moves.

- Other references: Google Hotels, Expedia, Marriott/Hilton/Hyatt (as large, tech-enabled hotel chains).

- Reporters/hosts: Kai Rizdahl (host), Megan McCarty Carino (Marketplace Tech).

Infrastructure details & business mechanics

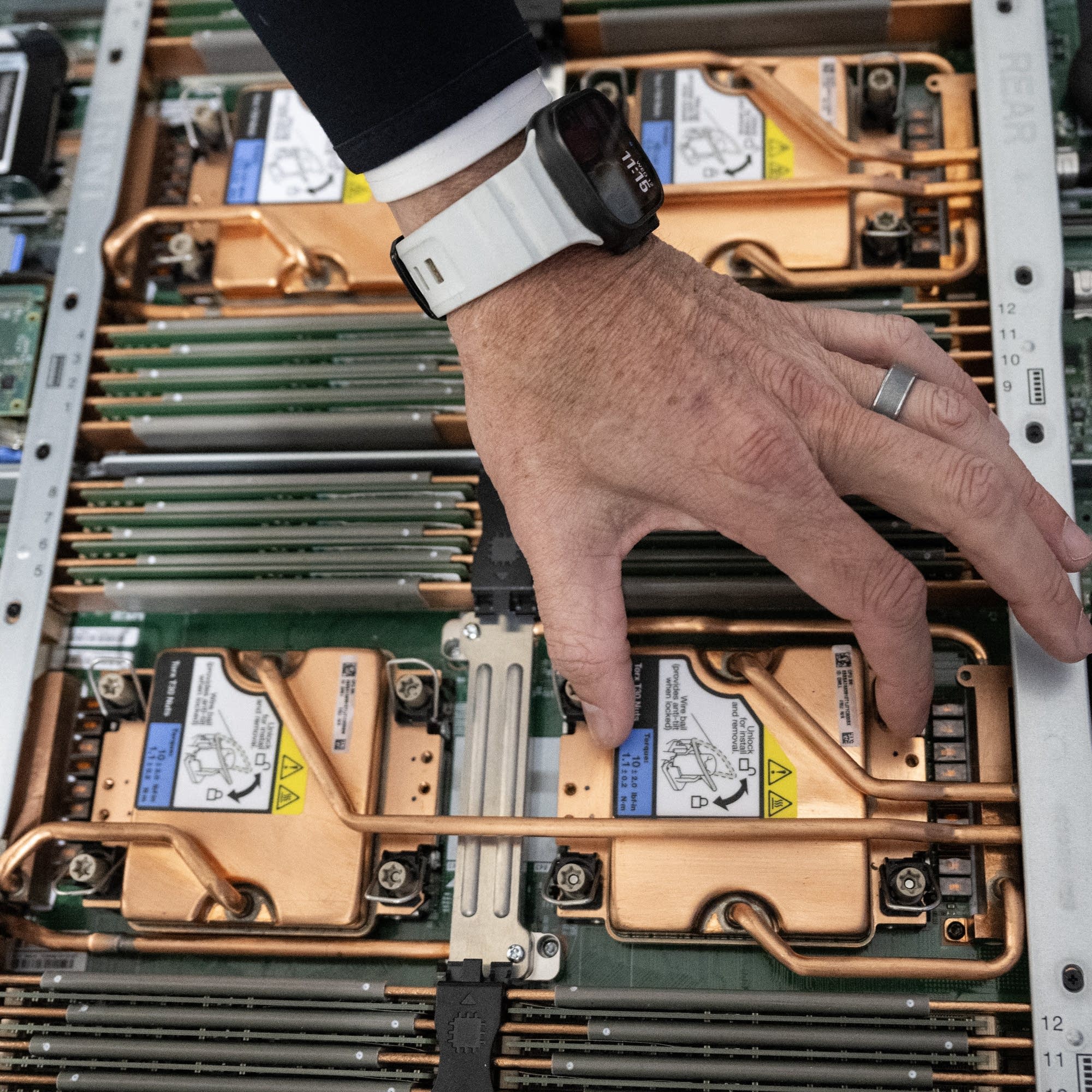

- Data-center space: big multi-floor halls are built and then leased; “go-live” and activation track closely with when utilities can supply required power.

- Pricing model for data-center tenants: charged per kilowatt (kW) based on power consumption—power is effectively the unit of sale.

- Meet‑me room (MMR): the exchange room where networks and customers interconnect; important for how cloud, telecom and customers interoperate.

- Timeline: large facilities can be built but stay empty until power/fiber is provisioned; leasing commitments often secured 12–14 months (or more) before capacity goes live.

Trade-offs, risks and community concerns

- Environmental/resource concerns: electricity and water consumption for hyperscale AI/data centers is a major local concern; communities fear higher utility costs and strained resources.

- Distribution of benefits: critics question whether local communities see tangible short‑term benefits (jobs, lower costs) versus longer-term, intangible gains (new medicines, services).

- Market risk: demand for data-center capacity is very high now, but there are questions about whether a bubble could burst or if energy constraints will limit growth.

- Equity/coverage: many rural or lower-income communities still lack basic broadband — raising questions about who benefits from AI infrastructure buildout.

Notable quotes / memorable lines

- Tinyfish CEO (paraphrase): The goal is to “bridge” the gap so small companies can compete as AI becomes more central to online discovery.

- On capital flows: “It is not a noble dollar, but we have amazing PR because we control most of the distribution of information now.” (comment on investors and influence)

- Digital Realty on pricing: “Power really is the currency.” (data-center pricing tied to kilowatt consumption)

Actionable takeaways for listeners

- If you live in (or represent) a community hosting data centers: ask local planners and utilities about projected power/water impacts, timelines for grid upgrades, and community benefit agreements.

- For small businesses and local service providers: AI-enabled middleware (like Tinyfish) may provide ways to compete in digital marketplaces—look for partners that can syndicate your inventory.

- For investors and retirement‑account holders: AI exposure is broad — not just model makers but infrastructure providers, middleware startups, and utilities; understand where your money is allocated.

- For policymakers: balance the urgent need for grid and broadband upgrades with local environmental and affordability concerns; anticipate coordination needs between developers and utilities.

Where to follow more reporting

- Marketplace Tech (Megan McCarty Carino) has ongoing reporting about AI infrastructure.

- Marketplace’s Instagram (Marketplace APM) and the Marketplace podcast feed for related segments and visuals of the sites visited.

This segment emphasizes that AI’s effects are already physical and geographical — from startup innovation to massive data-center builds — and that the economic and social trade-offs (power, water, jobs, who benefits) are still being sorted out.