Episode Summary — "164: Oak Cliff Swipers" (Host: Jack Rhysider)

Overview

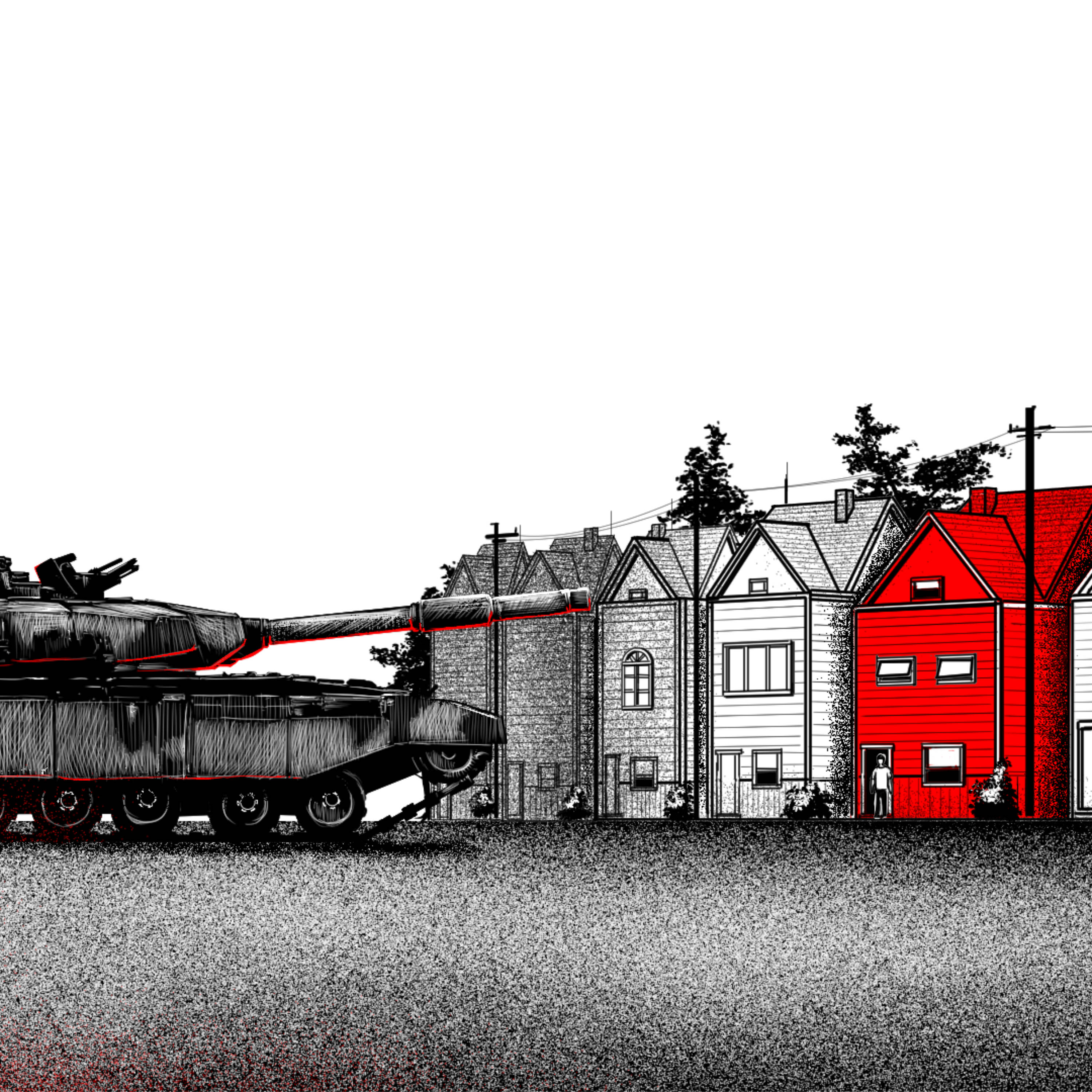

This episode of Darknet Diaries tells the true-crime story of Nathan, who grew up in Oak Cliff (near Dallas, TX) and built a large, real-world fraud operation that combined cybercrime tools (skimmers, MSRs, card dumps) with physical logistics (shoppers/swipers, printed cards, resale networks). The narrative covers his origin (gaming economy scams), escalation into credit-card theft and skimming, the operational details of running a local fraud supply chain, methods taught to “shoppers,” and the eventual law enforcement investigation and consequences (including prison and self-reflection).

Note: the episode contains explicit language and mature content.

Key Points & Main Takeaways

- Origin: Nathan began by selling in-game items (Diablo II, WoW). After repeated PayPal chargeback scams, he chose to become a fraudster.

- Environment: Growing up in a rough neighborhood shaped his worldview — survival mentality, hustling culture, exposure to violence and criminality.

- Early fraud methods: Buying stolen PayPal/credit access to purchase in-game currency; buying/selling "dumps."

- Transition to skimming:

- Bought skimmers, MSRs, embossers and other gear (sourced internationally).

- Installed Bluetooth-capable skimmers on gas pumps and ATMs; retrieved track data via USB/Bluetooth.

- Retail exploitation:

- Social engineering/manipulation at Walmart: using a “broken” card with many card numbers written on it to prompt manual entry and capture working numbers.

- Chicken Express drive-through scheme: girlfriend (employee) hid a skimmer in her apron, collected card data from cars when taking orders.

- Card production & usage:

- Used a Fargo card printer to make physical cards with mag-stripe data and even photos to pass casual ID checks.

- Employed local “shoppers/swipers” who used those fake cards to buy high-resale items (gift cards, electronics).

- Resale network: sold goods at steep discount locally and exported some stock across the border for cash.

- Scale & profit: The operation involved dozens of collaborators, multiple jurisdictions, and reportedly reached thousands of victims — Nathan claims big daily profits (e.g., ~$5k/day profit).

- OPSEC and tradecraft:

- Taught shoppers how to blend in, avoid cameras, and present themselves convincingly (hats, phones in hand, cover tattoos, plausible cover stories like being a worker buying gift cards).

- Route planning and batching purchases to reduce detection.

- Law enforcement & fallout:

- Multiple agencies across Texas investigated (including Secret Service and many local PDs).

- Nathan served significant prison time (13 years). He describes post-prison self-discovery, addiction issues, and regret.

- Human element: trauma, drug use, family dynamics, and the moral trade-offs that led him down this path.

Notable Quotes / Insights

- "Either you're getting scammed or you're the scammer. Might as well be the scammer." — Nathan explaining his early choice after getting scammed.

- "If you don't believe it's your money, you won't do good." — On the mindset required for a swiper to perform confidently in stores.

- "I was addicted to making money." — Summarizes the driving addiction behind the escalation.

- Practical insight about skimmers: later models were Bluetooth-enabled and could be read remotely; earlier ones required physical download.

Topics Discussed

- Video-game economy fraud (Diablo II, World of Warcraft)

- PayPal chargebacks and online scams

- Carding: dumps, mag-stripe data (track 1/track 2)

- Skimmers, MSRs, embossers, chippers, physical card production (Fargo printers)

- Social engineering at point-of-sale (manual entry, drive-throughs)

- Gift-card laundering and resale channels (eBay, local markets, cross-border)

- OPSEC and in-person tradecraft for fraud

- Law enforcement investigation and inter-agency coordination

- Personal background, addiction, incarceration, and rehabilitation

Action Items & Recommendations

For individuals:

- Inspect card readers before swiping (wiggle the reader; avoid suspicious overlays).

- Prefer EMV/chip and contactless payments; monitor bank/card alerts and set transaction notifications.

- Regularly check bank and credit card statements; report fraudulent charges immediately.

For merchants and employees:

- Train staff to avoid manual entry abuse: verify procedures for manual keyed entries and limit manager-override practices.

- Monitor for unusual gift-card bulk purchases or patterns (multiple same-day large purchases).

- Inspect and secure POS/card reader hardware frequently; install tamper-evident devices and cameras covering readers.

For security professionals & investigators:

- Look for patterns: clusters of fraud tied to specific merchants, repeated large gift-card acquisitions, re-sale routes.

- Monitor for Bluetooth/remote-access skimmer signatures and anomalous device footprints at pump/ATM endpoints.

- Coordinate across jurisdictions; fraud rings often span many local agencies and involve cross-border resale chains.

For parents/community:

- Address social and economic drivers that push kids toward crime: mentorship, economic opportunity, education on online risks.

Final Note

The episode is valuable both as a cautionary tale on how physical and digital fraud techniques combine, and as an inside look at the psychology, tradecraft, logistics, and social dynamics of a local fraud enterprise. It highlights how relatively low-tech physical tactics (skimmers, social engineering) integrated with simple digital tools can scale into significant criminal operations — and how community context and personal choices fuel escalation.